The Promise of Synthetic Data in Financial Innovation

In the world of finance, data privacy and regulatory compliance are paramount. As organizations strive to innovate and adopt new technologies like artificial intelligence, they often encounter challenges related to the use of real customer data. Here enters the concept of synthetic data, which has recently emerged as a transformative tool for bridging the gap between development and production environments.

Understanding Synthetic Data: More Than Just Fake Numbers

Synthetic data refers to information that is artificially generated rather than obtained by direct measurement. By leveraging technologies like Generative Adversarial Networks (GANs), developers can create datasets that accurately reflect the statistical properties of real data without compromising personal information. This is particularly beneficial in finance, where strict privacy regulations often hinder data access. For instance, financial institutions need to adhere to GDPR guidelines and ensure customer confidentiality, making the generation of synthetic data both a prudent and advantageous solution.

Why Financial Institutions Should Embrace Synthetic Data

1. Protecting Personal Privacy:

With synthetic data, organizations can analyze trends and build models without risking the exposure of sensitive information. This data does not include real personal identifiers, making it a secure alternative in case of a data breach.

2. Ensuring Regulatory Compliance:

Synthesized datasets allow financial entities to share information safely, adhering to privacy regulations without violating confidentiality. This process fosters a privacy-by-design approach, which ensures compliance while paving the way for data-driven innovation.

3. Accelerating Access and Development:

The traditional pathways to access production data are often slow and riddled with bureaucratic hurdles. Synthetic data can be generated quickly, eliminating delays and ensuring that developers have fast, reliable access to the realistic datasets they need.

4. Retaining Business Logic:

Unlike random anonymization techniques that may obscure valuable patterns, properly generated synthetic data maintains the relationships and statistical integrity of the original dataset. Research reveals that models trained on synthetic data can achieve accuracy levels comparable to those trained on authentic data.

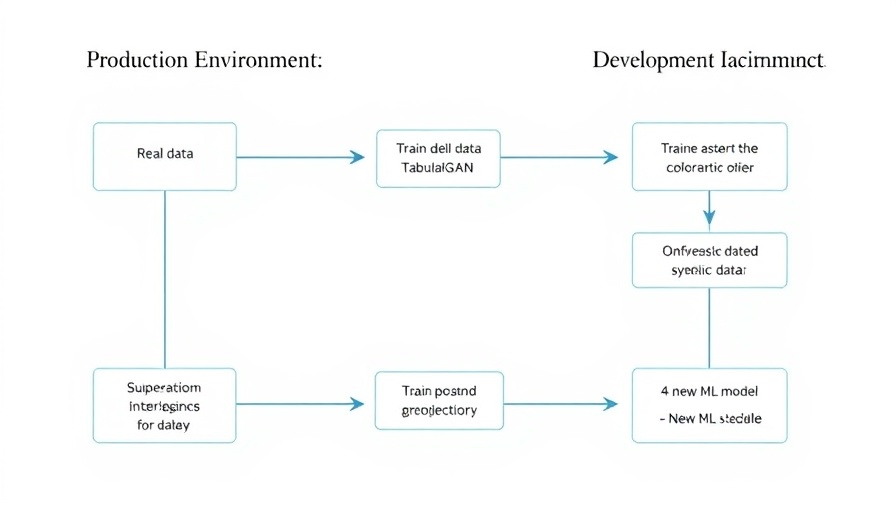

Implementing a Tabular GAN Model in Production

The journey to harnessing synthetic data begins with training a GAN model in a secure production environment. This crucial first step involves using proven methods to ensure that real data remains undisclosed while still allowing the GAN to learn from authentic patterns. By keeping the data within the production servers, organizations can capitalize on the benefits of GANs without compromising security.

The Future of AI and Synthetic Data in Finance

As organizations recognize the value of synthetic data, the landscape of financial technology is poised for disruption. The convergence of advancements in AI learning and synthetic data opens new avenues for innovation. Institutions can leverage this synergy to not only refine their models but also adapt more rapidly to changing market dynamics.

Challenges and Considerations for Developers

While the benefits of synthetic data are compelling, there are challenges to navigate. Developers must ensure the accuracy and applicability of the synthesized datasets they create. Furthermore, creating a balance between data fidelity and innovation remains crucial — achieving this will require continuous advancements in the underlying technologies.

Conclusion: Bridging the Divide in Finance

Synthetic data stands at the forefront of technological innovation in finance, providing organizations with a means to explore advanced analytics while ensuring compliance and security. As developments continue, financial institutions must adopt a proactive approach to embracing synthetic data as part of their AI strategies. By doing so, they can not only safeguard sensitive information but also drive transformational change in their operational practices.

Call to Action: For finance professionals looking to navigate the evolving landscape of AI and synthetic data, investing time in understanding these technologies is crucial. Start today by exploring potential synthetic data applications in your organization to harness their full potential.

Add Row

Add Row  Add

Add

Write A Comment