Understanding the Role of AI in Smart Banking

In an era where financial markets are increasingly volatile and regulatory environments grow more complex, the integration of AI technology into banking is not just innovative; it's essential. The challenges faced by banks today demand robust strategies for both compliance and profitability. With the introduction of solutions like SAS's Asset and Liability Management (ALM) system at Alliance Bank, we can see firsthand how AI is revolutionizing traditional banking operations.

The Transformation at Alliance Bank

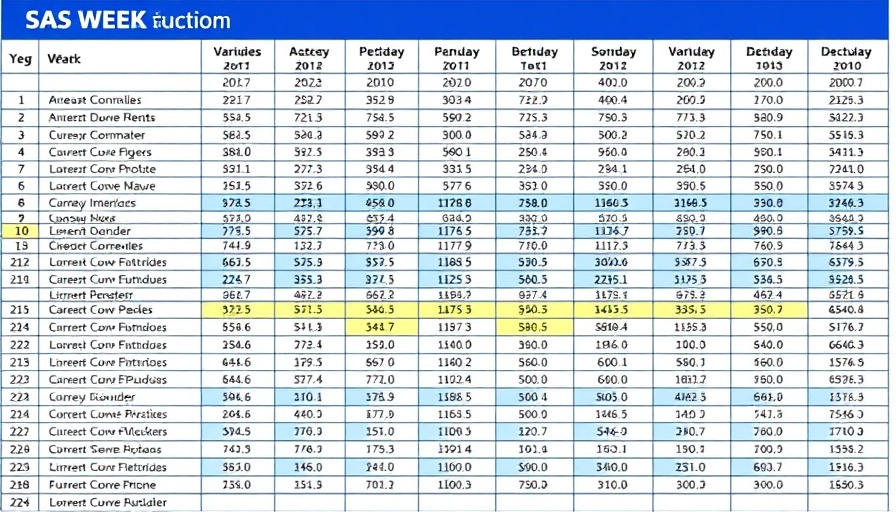

Alliance Bank Malaysia Berhad recognized the importance of proactive risk management and the necessity for a reliable flow of information to support strategic decision-making. By adopting SAS ALM, the bank significantly improved system scalability, availability, and analytical processing speed by tenfold. This isn't merely a technological upgrade; it’s a complete transformation of their operational strategy.

The Key to Optimizing Resources

With the deployment of AI-driven tools, Alliance Bank was able to automate 90% of its ALM-related processes. Such automation leads to substantial benefits, including a 10% reduction in operational costs, labor expenses, and production time. This is particularly crucial in a sector where efficiency translates directly into profitability, allowing banks to allocate resources more effectively while maintaining compliance with evolving regulations.

Future Predictions: The Role of AI in Regulatory Compliance

Looking ahead, we can expect to see an even greater reliance on AI to navigate the future landscape of banking regulations. With predictive analytics and machine learning algorithms, banks will be able to preemptively identify compliance risks and adjust their strategies accordingly. This foresight will not only improve regulatory adherence but also enhance overall risk management frameworks.

Aligning Business Goals with AI Technologies

As witnessed with Alliance Bank's ‘Acceler8’ plan, it's critical for businesses to align their growth objectives with technological enhancements. The aim to double small business loans by 2027 while ensuring compliance means that the integration of AI must become a core strategic pillar. This integration demonstrates the unique benefits of understanding not just AI’s functionality, but its potential to drive overall business transformation.

Common Misconceptions about AI in Banking

There remains a prevalent misconception that AI adoption in banking is solely about cutting costs. However, it’s equally about enhancing the customer experience and making informed decisions. AI technologies allow for more personalized banking solutions, which can lead to higher levels of customer satisfaction and loyalty. In an age where customer expectations are evolving, banks must recognize that AI is key in both cost management and delivering exceptional service.

Topics such as AI learning and AI science are increasingly more relevant for industries as diverse as technology and finance. Understanding these areas can provide crucial insights into how AI not only supports existing processes but shapes the future of banking.

Concluding Thoughts: The Path Forward

The journey towards fully integrated smart banking is underway, and as AI continues to evolve, so too will its applications in the finance sector. For those looking to stay informed, engaging with current AI educational resources and workshops will be vital. By honing in on AI learning paths, individuals and businesses alike can position themselves to thrive in this rapidly advancing landscape.

Add Row

Add Row  Add

Add

Write A Comment